Inflation is a pervasive problem in today’s economy that can have devastating effects on individuals and their financial security. Acquiring valuable commodities, namely gold or silver, presents individuals with a viable solution to safeguard against the perils of inflation. But why should someone consider investing in these materials?

First, let’s take a look at what makes precious metals so attractive when considering investments: they are tangible assets with intrinsic value; they are relatively liquid, and they hold their value over time, even if the stock market experiences volatility. In addition, gold and silver often increase in price when faced with economic uncertainty because investors view them as safe-haven assets that tend to outperform stocks during volatile times.

Finally, there are several ways to invest in precious metals which allow you to spread out your risk while still taking advantage of potential gains – from buying physical coins or bars directly to trading futures contracts on exchanges like COMEX. Through a comprehensive examination of potential investment opportunities and a thorough comprehension of the benefits associated with allocating resources towards precious metals, individuals can acquire a deeper understanding of strategies that optimize the safeguarding of their financial assets amidst inflationary pressures. The thesis statement for this article is: Investing in gold or silver offers numerous benefits, including protection from inflationary pressures by diversifying your portfolio into tangible assets with intrinsic value that maintains their worth even during periods of market volatility.

Table of Contents

The Benefits Of Investing In Precious Metals To Combat Inflation

Diversifying one’s investment portfolio by allocating funds towards precious metals presents a savvy approach to alleviating the negative effects of inflation and safeguarding long-term financial stability. The inclusion of gold, silver, platinum, and palladium within an investment strategy can serve as a protective measure against the depreciation of monetary units stemming from mounting costs. They are also reliable stores of value that have withstood the test of time.

Precious metals also come with tax benefits due to their status as collectibles, which makes them an attractive option for investors seeking ways to minimize taxes on their investments. All these benefits make investing in precious metals an ideal way for individuals looking for security during times when other asset classes may be volatile or uncertain.

Understanding the different types of precious metals available and their value is key when making any investment decisions related to them since each type carries its own unique set of characteristics that could impact pricing and performance.

Understanding The Different Types Of Precious Metals and Their Value

In the realm of financial investments and safeguarding one’s assets against the erosive impact of inflation, precious metals present a highly desirable alternative.

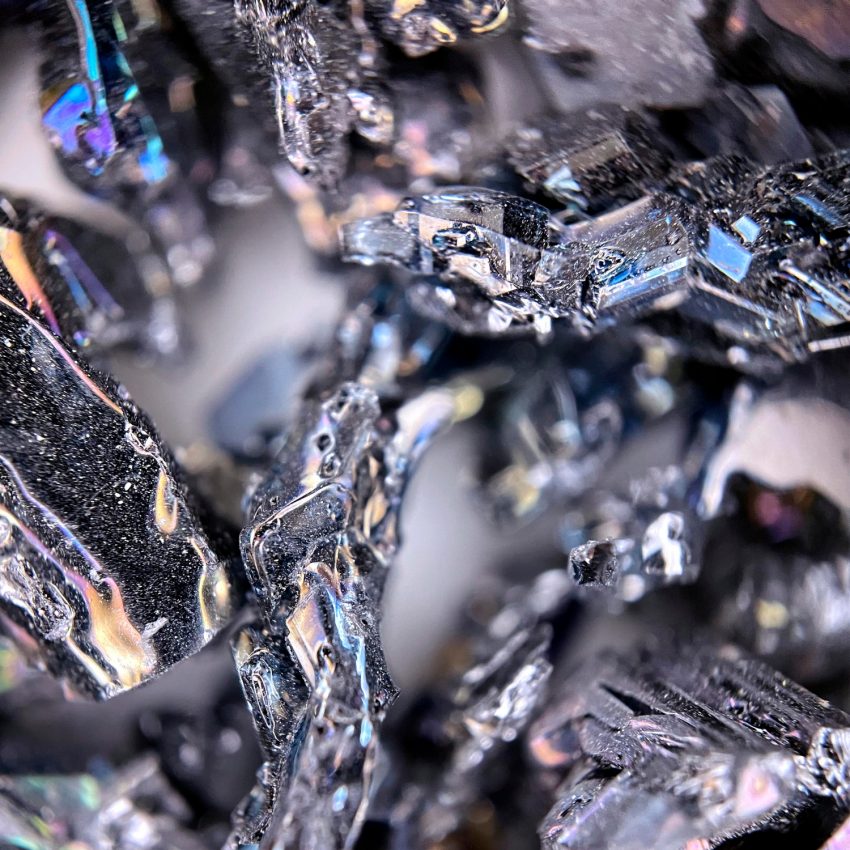

Gold has been seen as an investment for centuries due to its rarity and value. Owing to its exceptional aptitude for resilience, it is universally acknowledged as one of the most reliable investment alternatives during times of economic turbulence, given its consistent and enduring tendency to maintain a relatively stable value over protracted intervals. Silver is another popular form of precious metal that is often used as an alternative or supplement to gold investments because it offers greater liquidity than gold. Platinum and palladium are two other rarer options that have recently become more attractive due to their increasing scarcity in comparison with other materials like copper or aluminum.

It is imperative to comprehend the exclusive merits proffered by every metal type when contemplating protection against inflationary impacts on one’s financial portfolio. Selecting the most fitting metal variant according to one’s requirements is fundamental before embarking on any investment decisions. For instance, gold may be the optimal choice for those seeking long-term stability, given its value does not undergo significant alterations over time. Conversely, silver may be more suitable for shorter-term investments, owing to its tendency to experience rapid price fluctuations contingent on market conditions. Hence, it is crucial to conduct comprehensive market research and analysis, guided by a prudent investment strategy, to ensure maximum returns and optimal protection of one’s financial interests.

It is imperative to possess a comprehensive understanding of the investment landscape prior to allocating any capital towards metal-based assets, regardless of the specific type selected for inclusion in one’s portfolio. This awareness enables an informed decision-making process whereby the optimal balance between risk tolerance and potential returns can be achieved through the implementation of effective investment strategies. With proper research into each type available, along with some basic knowledge about market trends and financial planning techniques, anyone can successfully invest in precious metals as part of a robust portfolio designed specifically for combatting inflationary forces head-on.

Strategies For Investment and Long-Term Planning With Precious Metals

An extensive comprehension of the diverse alternatives accessible is imperative in order to make well-informed investment choices within the domain of precious metals. A variety of investment avenues exist for individuals seeking to diversify their portfolios with precious metals. Such options encompass procuring physical bullion coins or bars from established dealers or online retailers, like Legacy Precious Metals, investing in exchange-traded funds (ETFs) that monitor the ebb and flow of precious metals prices, engaging in futures contracts via reputable exchanges such as COMEX, and deploying derivatives, such as options and swaps, to achieve investment objectives. It is essential for prospective investors to conduct comprehensive research prior to engaging in any specific strategy, as each avenue offers a unique array of risks and rewards.

In addition to understanding how each type of investment works, it’s also helpful to keep an eye on global economic trends that could affect the price of precious metals. In times of economic uncertainty or high inflation rates, demand for these commodities typically increases, which drives up prices—making them a great choice for protecting against market volatility over time. For investors seeking a safeguard against market volatility, an asset with minimal correlation risk may prove valuable. In such circumstances, precious metals such as gold are viable options. Their historical performance during uncertain times has established them as an asset class that offers diversification benefits to a portfolio.

Conclusion

In summary, investing in precious metals is an effective way to fight inflation. Talking about the investment, precious metals are regarded as highly desirable assets with the potential to appreciate in worth over an extended period.

The discerning investor who seeks to shield their assets from the erosive impact of inflation would do well to consider the wisdom of allocating funds towards precious metals. They are easy to purchase, store, and liquidate when needed. Plus, they offer peace of mind knowing your assets will remain secure no matter what happens with the economy or markets.